Nowadays, pretty much every driver relies on some form of finance or credit to fund their next vehicle purchase. But if you have never had finance before, you may be wondering if it is the right choice for you. Vehicle finance is very flexible, and you can even get finance for a van, car, caravan, or motorbike.

Whilst finance is a current way to spread the cost of your next vehicle, it will not be accessible to everyone who applies. It would not be fair for finance lenders to offer deals to everyone who applied as they may not be able to afford to pay it back. This is why lenders put certain criteria in place which borrowers will need to meet before they could be considered. Keep this in mind when searching around for cheap finance deals.

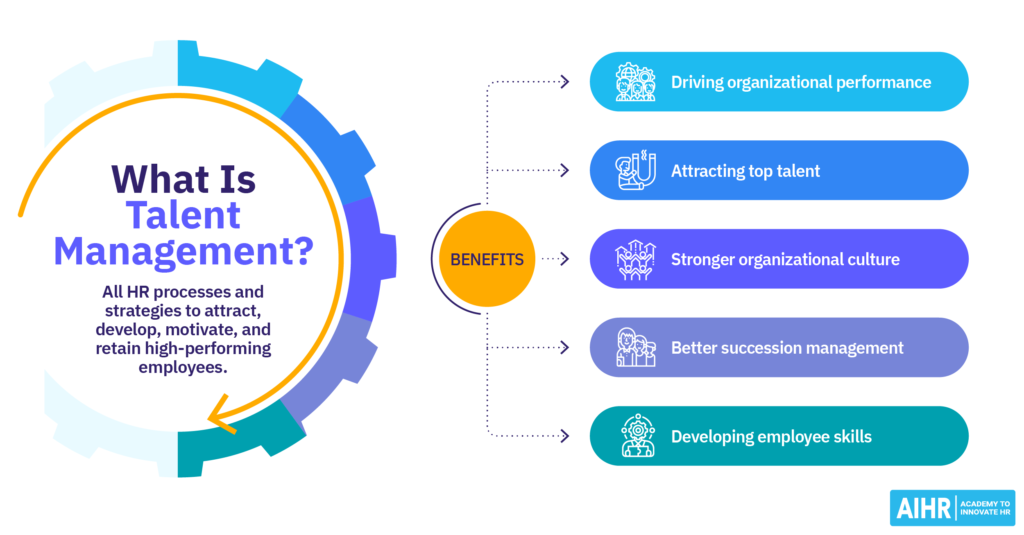

Benefits of using finance

- Spread the cost. The biggest benefit of using finance to fund your next vehicle is the ability to spread the cost. Vehicle finance deals can be spread over several years, usually between 3 and 5 years. You make monthly payments to pay off your finance deal during this time. You can adjust your finance loan term to suit your monthly budget and make advanced payments to pay off the loan quicker.

- Get a better vehicle. Usually, vehicle finance allows you to get a newer, better model than you would if you were paying with cash. Saving up for your vehicle can be hard and would take a while to save up a lump sum payment for a car or van. This is where finance can help you to buy a newer car but pay for it in monthly instalments.

- Improve your credit. It is a common misconception that relying on finance is a bad thing. However, using finance to fund your next vehicle can help to improve your credit score. When used correctly, finance can help to improve your credit score. When you make each payment, you owe on time and in full, you are helping to better your credit and show future lenders you can be trusted with paying back your finance.

Drawbacks of vehicle finance

- You may not own the car. This is a big one for many drivers and can be off putting. Many finance deals are secured loans which means you will not own the car until the end of the agreement. This also means if you fail to keep up with your payments, the lender could have the right to take the car off you.

- You will pay interest. There are 0% interest finance deals on offer, but they are usually for brand-new cars and the higher monthly payments could make it hard to afford. Usually, you will need to pay interest on your loan. Paying interest means you will pay more back than you borrowed. The rate of interest you are offered can depend on a several factors such as your credit score, the loan amount, the length of the loan term and more. When looking for finance, you should always select the deal with the lowest interest rate to ensure you are not paying more than you need to.

- Mileage and damage charges. Some finance deals such as Personal Contract Purchase (PCP) can put mileage and damage restrictions in place. This is because the loan is calculated on a future value amount and by agreeing to keep the car in good condition and within an agreed mileage, the lender can estimate the value of the car at the end of the deal. If you exceed the mileage or return the car in a condition which goes beyond general wear and tear, there can be additional charges to pay.