Consider this: you diligently researched and purchased a term insurance policy years ago. It fully suits your needs at that moment. However, life has taken some unforeseen turns. Perhaps your family has grown, your work has thrived, or your health requirements changed. Now you’re wondering if your current term insurance policy still provides the best protection for you and your family. Ideally, you’d like to switch to a plan that better fits your current circumstances. But is this even possible?

The good news is that in India, you may have the option of life insurance portability. This allows you to move your coverage to a new insurer while perhaps keeping some of the benefits of life insurance that you currently have. However, before you jump ship, there are a few important points to consider. In this article, we will discuss the term insurance portability, examining the benefits of life insurance if you port to help you make an informed decision.

What is Term Insurance Portability?

Term insurance portability refers to your right as a policyholder to change your insurance or provider. It means you can change your existing insurance company without losing any accumulated benefits or premiums paid. All of those perks and payments are carried forward into the new best life insurance policy as per your needs. This feature is intended to keep you from being “stuck” to the contract.

How Does Term Insurance Portability Work?

Term insurance portability allows you to continue receiving coverage even if your insurer’s benefits change. For example, your benefits may vary if you lose your job, your spouse’s coverage expires, you separate, or your insurer reduces your coverage. These things are known as “triggering events.”

If you switch your insurance to the best life insurance policy, you’ll get a new term insurance policy that will last as long as you pay your premiums or until you reach the insurer’s maximum age restriction. Depending on the options provided by your insurer, you can pay your premiums annually or at a time specified by the life insurance. This means that those who are currently covered by a life insurance policy can switch to a different insurance company without losing their current policy. Only health insurance plans can now be transferred across insurance providers under IRDAI regulations. Term insurance policies cannot be transferred. To cancel an existing life insurance policy before it matures, a surrender fee must be paid. It may comprise up to 70% of the total premiums paid throughout the policy period. India currently has no provisions that allow the move from group life insurance to a personal plan regarding term policies.

Benefits of Term Insurance Portability

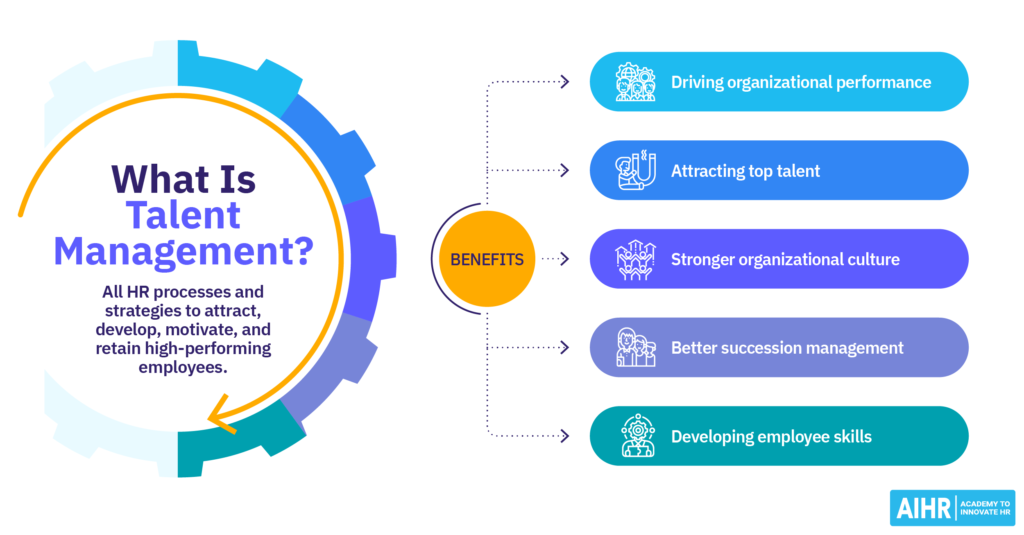

Putting policyholders’ interests first, IRDAI has proposed implementing a protective measure that provides their flexibility in selecting the best plan for them. Portability allows policyholders to switch insurers and explore better offers and benefits of life insurance from other insurance companies. The following are some possible benefits of acquiring a portable term best life insurance policy:

Financial security for your dependents: The payout from the best life insurance policy could cover anything as simple as your family’s monthly costs in your absence. With the financial support provided by the term plan after you, your family can consider pursuing other important ambitions, such as higher education and weddings. Portability allows you to keep the money you’ve saved throughout the years.

Medical contingencies are covered seamlessly: Every household should be ready for medical crises. Some term insurance policies cover terminal illnesses and other life-threatening medical problems. With the portability option, you may also customize the new insurance to meet your needs.

Protection of your assets: Loans you take out while you’re well may cost your family a lot of money in your absence. With a portable best life insurance policy, your family may be confident that your debts will be paid off without the need to sell any family assets or money.

How Do I Port a Term Insurance Policy?

One of the benefits of life insurance, any policyholder may request a transfer of their current term insurance plan as long as it continues to exist and the premiums are paid immediately. Here is a step-by-step explanation on how to port your term insurance policy.

Step 1: Send your insurer a written request for portability at least 45 days before the policy renewal date.

Step 2: After submitting the application, some papers will be required, including a portability form and a proposal form from the new insurer.

Step 3: The new and old insurers will exchange verification requests for your medical records and other critical information that was previously shared with the old insurer.

Step 4: After receiving such a request, the original insurer must give all relevant information to IRDA India.

Step 5: Once the new insurers have all of the necessary information about your policy, they will decide whether or not to provide you with new coverage. This approach is known as policy underwriting. If they decide to move forward, they must furnish you with a new policy within 15 days.

Step 6: After both insurers have completed their policy term comparison, the new insurer will issue a transfer certificate.

In conclusion.

It is very much possible that after a period of time, the policy you have bought doesn’t seem to cater to your present and future needs. If you find a better price with another insurer, you may want to consider porting your term insurance coverage. However, before making a decision, the advantages and disadvantages must be properly considered. Consider speaking with a financial expert to see whether transferring your term insurance plan is the correct decision for you.