After-retirement investment planning involves saving a portion of your income for retirement through a dedicated fund, which is then invested in various assets, including stocks, bonds, property, and more. This is vital to ensuring financial stability and peace of mind. Reputed service providers play a significant role in managing and optimizing these investments for better returns.

Superannuation investment prepares you for retirement and protects against economic uncertainties. The goal is to grow your savings over time, and contributions are typically made by both the employer and the employee, creating a collaborative effort to build a sound after-retirement future. Over the years, the money invested earns returns, and these returns, in turn, earn more returns. Read on to discover the benefits and strategies for a secure financial future.

Enhancing Life Safety Standards

Life is unpredictable; unforeseen events such as illness, disability, or job loss can severely impact monetary stability. Superannuation funds often include insurance options that cover life, disability, and income protection.

These insurance policies can provide crucial support during challenging times, ensuring you and your family are not vulnerable. Knowing that you have a growing fund dedicated to your future can alleviate stress and allow you to focus on other essential aspects of life, such as personal growth, family, and hobbies.

This monetary safety net empowers you to live a fuller, more balanced life without the constant worry of financial instability. Aligning your portfolio construction with these principles ensures that your investments are structured to provide growth and protection, reflecting a commitment to safeguarding your economic well-being and enhancing overall life safety standards.

Holistic Well-Being

A robust after-retirement monetary plan provides the freedom to make life choices without the constraint of financial limitations. For instance, with a secure superannuation fund, you may have the flexibility to retire early, pursue passion projects, travel, or even start a business. The financial independence gained from a well-managed superannuation fund allows you to live life on your terms. Financial stress is the most common and general cause of anxiety and depression, and eliminating this stress through a secure plan can lead to improved mental health.

The peace of mind that comes from knowing your future is secure can enhance your overall standard of living, allowing you to cherish the present without constant worry about the future. Integrating these aspects into your portfolio construction ensures that your investments are aligned with your holistic well-being goals, promoting more than just economic growth.

Long-Term Financial Strategy

Such investments are not just about the immediate benefits but also about the future rewards. Starting early and making regular contributions can significantly amplify the benefits of compounding interest, leading to a more substantial retirement fund. Even small contributions made consistently can grow significantly over the years. Moreover, these funds often provide access to professional financial advice and management. This expertise can help optimize your investment strategy, ensuring that your superannuation fund is managed effectively to maximize returns and minimize risks.

With professional guidance, you can make practical decisions about asset allocation, contribution levels, and insurance options, tailoring your strategic investment to your unique financial goals and circumstances. Aligning your portfolio construction with this long-term approach ensures that your investments are strategically positioned to benefit from compounding growth, professional management, and tailored financial advice.

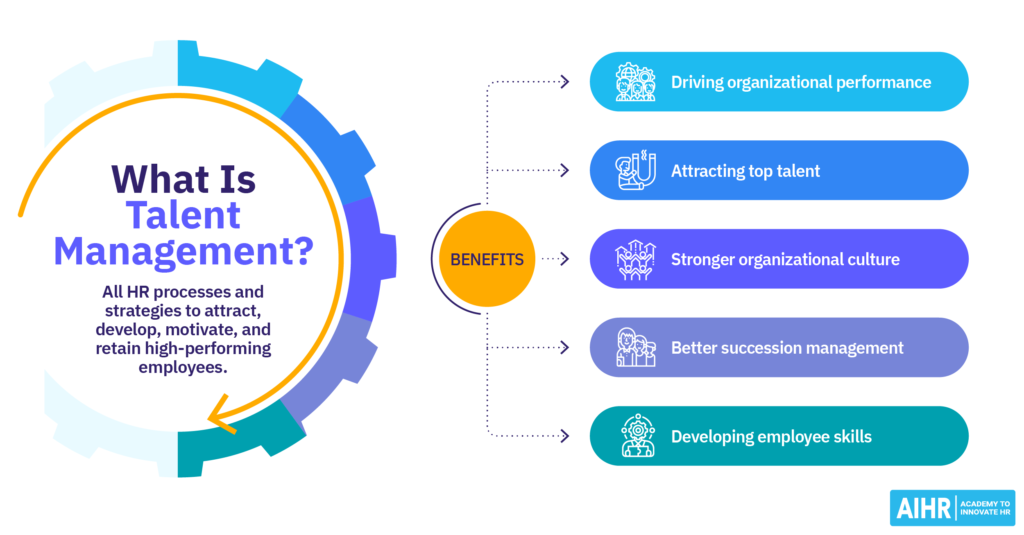

Reputed service providers for superannuation investment, such as financial institutions and specialized super funds, offer intuitive solutions tailored to your unique preferences. They provide expert advice, comprehensive management, and strategic investment options to maximize returns. By evaluating your risk tolerance and financial goals, these providers ensure that your superannuation fund is optimized for retirement security. Trusting these experts can significantly enhance your financial stability and peace of mind, providing a prosperous future.